Getting MWRR Right: Why It’s More Complex Than You Might Think

Explore money-weighted returns (MWRR) under NI 31-103, key factors for accuracy, and how MWRR differs from time-weighted returns.

.jpg)

In the NI 31-103 regulated environment, the shift toward money-weighted rate of return (MWRR) reporting has introduced a new layer of complexity (and opportunity) for firms and clients alike. In this article, we break down why MWRR is more than just a straightforward calculation, what factors go into an accurate MWRR calculation, and when MWRR and time-weighted rate of return (TWRR) calculations have a place in your reporting.

The Complexities of MWRR: It's Not Just a Simple Number

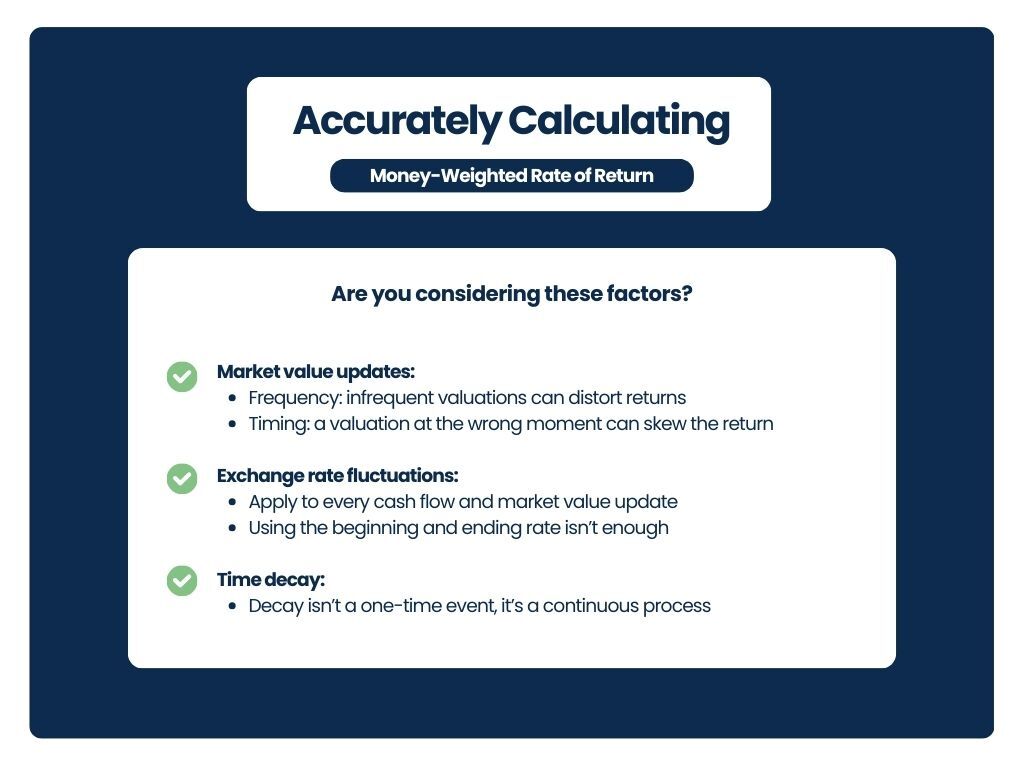

Accurately calculating MWRR, especially for private capital firms, is more complex than it seems. Factors like exchange rates, market value updates, and time decay must be applied continuously, and not just as a single adjustment. These changes must be applied at the beginning, end, and throughout the life of a transaction.

- Market value updates: For illiquid or privately held assets, infrequent valuations can create perceived volatility in the MWRR. The timing of these updates is crucial, as a valuation applied at the wrong moment can drastically skew the return.

- Exchange rate fluctuations: This must be properly applied to every cash flow and market value update. It's not enough to simply use the beginning and ending exchange rates. A foreign investment’s return may be diluted or amplified by currency shifts that occur throughout the investment period.

- Time decay: Time decay and other complex valuation factors for assets like options or structured products must also be accurately captured. This decay isn't a one-time event; it’s a continuous process that affects the asset's value over time, directly influencing the MWRR.

These complexities are where robust software solutions like Raisr come in, managing these nuanced calculations with accuracy and efficiency. Calculating MWRR isn’t as simple as punching numbers into a calculator, and there’s no easy way to verify if you’ve done it right. That’s why using a system with access to all your real-time investment data is the most reliable option.

Accuracy is non-negotiable in your reporting, and using the right technology to achieve it is a no-brainer.

MWRR vs. TWRR: What’s the Real Difference?

The fundamental difference between these two calculations is how they treat cash flows.

MWRR reflects the actual investor experience. It accounts for the timing and size of cash flows such as deposits, withdrawals, dividends, and fees, and shows the return that the investor actually earned on their specific investment journey. Essentially, MWRR is the Internal Rate of Return (IRR) for the portfolio. This calculation is particularly relevant for private capital clients in Canada, where investment timing and size can vary dramatically.

TWRR isolates the performance of the underlying investments by removing the impact of cash flows. It's ideal for comparing a fund manager's skill or a fund's performance against a benchmark index. TWRR answers the question: "How well did the investments themselves perform, regardless of when money was put in or taken out?"

Under NI 31-103, firms must report MWRR to clients, even if they also show TWRR. This regulatory choice emphasizes the investor’s personal journey over abstract performance metrics.

Why This Matters to Clients

Clients often ask: "Why does my return look different from the fund’s performance?"

The answer lies in cash flow timing. If a client invests heavily just before a market downturn, their MWRR will reflect that poor timing, even if the fund's TWRR performance looks good over the long term. MWRR directly connects an investor's behavior to their outcomes.

This is especially relevant in exempt market investments, where contributions and redemptions are often large, irregular, and tied to liquidity events, making the MWRR a more accurate reflection of the investor's return.

Use Cases for MWRR and TWRR

As software providers in this space, we see firsthand how critical it is to educate clients on these distinctions. A well-informed investor is better equipped to make strategic decisions and to appreciate the value of your advice and platform.

Are you currently navigating NI 31-103 reporting or looking for better ways to communicate performance metrics to your clients? See just how easy, efficient and impactful your reporting process can be. Book your demo here.